LemonStand Version 1 Has Been Discontinued

This documentation is for LemonStand Version 1. LemonStand is now offered as a cloud-based eCommerce platform.

You can try the new LemonStand and learn about upgrading here.

Configuring LemonStand for tax inclusive environments

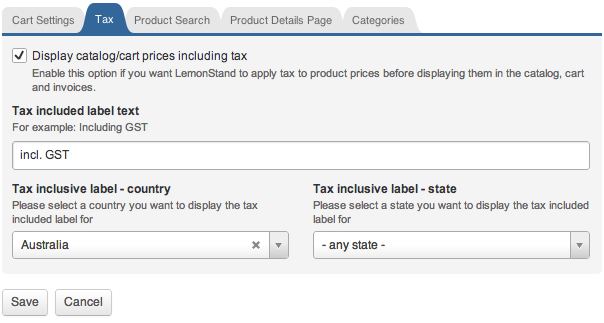

To enable the feature, please go to the System/Settings/eCommerce Settings page and click the Display catalog/cart prices including tax checkbox:

Also on this form you can configure the tax included label. To output the tax included label on the front-store please use the tax_incl_label() function.

Even if the tax included feature is enabled, LemonStand displays all product prices and order totals in the Administration Area in the tax exclusive mode.

Disabling the tax inclusive feature for specific customer groups

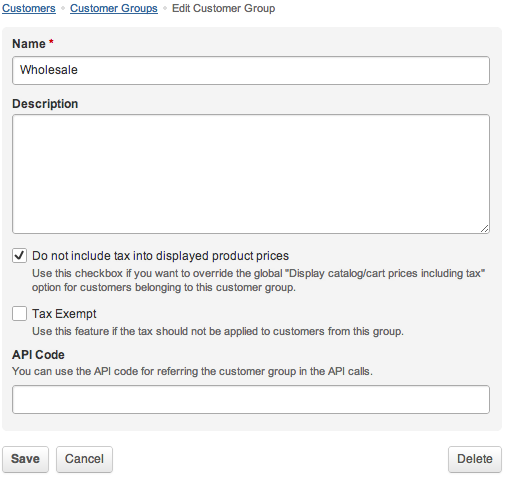

In some tax jurisdictions you may need to display catalog and cart prices without tax included for wholesale customers. You can disable the tax inclusive feature on customer group level. Go to the Shop/Customers/Manage Customer Groups page and click a customer group you need. On the customer group configuration form click the Do not include tax into displayed product prices checkbox:

Email templates

Order-specific email template variables (order_subtotal, order_content, etc) reflect the Display catalog/cart prices including tax option state. If you enabled the feature, prices in your email notifications would be displayed with tax included. You may also need to use the {tax_incl_label} variable in your email templates to output the tax included label.

Printing invoices with tax included

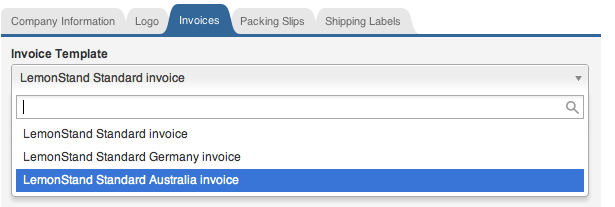

Requirements for invoices are different for different countries and tax jurisdictions. The default invoice implementation does not include tax into product prices and order totals. We developed other invoice templates, for example for Australia and Germany. You can select a suitable invoice template on the System/Settings/Company Information and Settings page:

Alternatively you can develop your own invoice template as it is described in the Customizing Invoices and Packing Slips article.

Discounts

When the tax included feature is enabled, LemonStand treats discounts defined on the Shop/Discounts page, as a sum of a discount and a tax part. Thus, if your tax rate is 10% and you created the "Discount each cart item by $3" price rule, LemonStand will discount items by $2.73. Discounts are displayed on the front-store in the tax inclusive mode, so the displayed discount value still will be $3. However in the Administration Area you will see that the total order discount is $2.73, because as we mentioned earlier, Administration Area always work in the tax exclusive mode.

Displaying specific fields on the cart or order review pages

The content of the cart, order review and invoice pages depends on tax laws. In Germany, for example, you need to output the Net Amount value which is calculated as $total - $tax. Also you may need to display a list of taxes applied to each cart item. You can find a list of available cart item, order item and checkout variables on the following pages:

- Shop_CartItem class - represents an item in the shopping cart. You work with objects of this class on the Cart and Checkout pages.

- Shop_OrderItem - represents an item of an existing order. These objects are accessible on the Receipt and Order Details pages.

- shop:checkout action - you work with this action on the Checkout pages. It generates many PHP variables which you can output on the checkout pages.

Updates in the Payment Receipt and Order Details pages

If you need to display item prices and order subtotals in the inclusive tax mode, please update your payment receipt and order details page as it is described on the following pages:

Previous: Configuring the Product Search feature

Return to Merchant Guide